Preparing for the 2024 Municipal Budget

As we head into budget discussions for fiscal 2024, the Municipality would like to share some information with you about the state of revenues over the past few years, taxation rates, inflation, operating costs, and some of the realities we face in the coming year. We hope you find this information helpful, as Council prepares to review the first draft of the 2024 budget on Thursday, February 1st.

Taxation Information

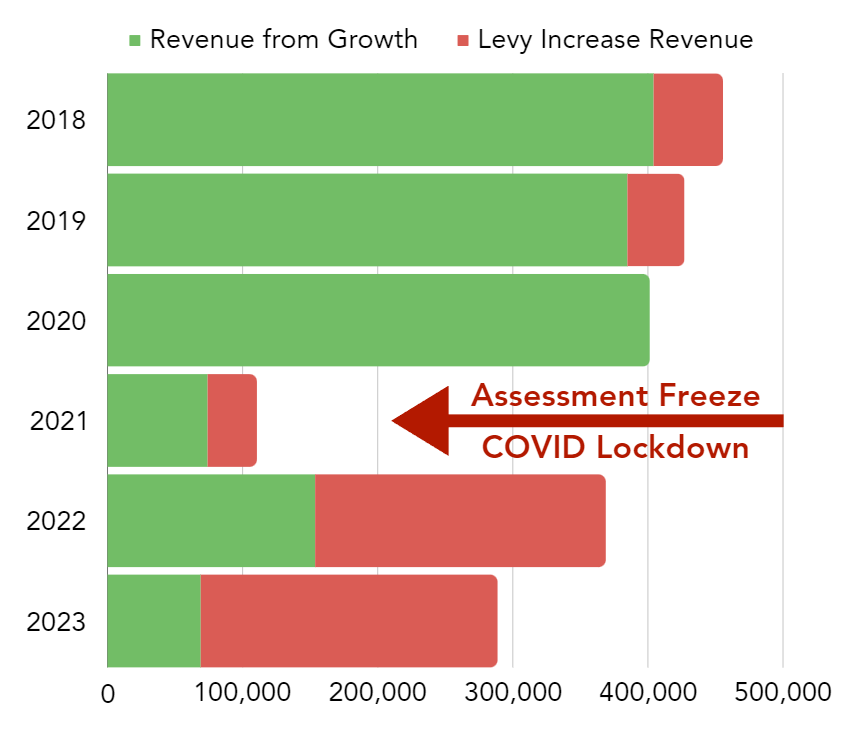

There are generally two ways that Municipal revenues increase - assessment growth and increasing the tax rate. For many years, we have been able to balance the budget with small increases to the tax rate as property assessments were updated and property values changed. You can see this in the chart to the right - where the vast majority or ALL of our revenue growth came from growth in our assessment base. When the pandemic struck in 2020, the Ministry of Finance put a freeze on property assessments. You may also hear these referred to as MPAC assessments. The Ministry of Finance is not supporting Ontario municipalities to help compensate for this loss of revenue; now we must recover this revenue through tax rate increases.

There are generally two ways that Municipal revenues increase - assessment growth and increasing the tax rate. For many years, we have been able to balance the budget with small increases to the tax rate as property assessments were updated and property values changed. You can see this in the chart to the right - where the vast majority or ALL of our revenue growth came from growth in our assessment base. When the pandemic struck in 2020, the Ministry of Finance put a freeze on property assessments. You may also hear these referred to as MPAC assessments. The Ministry of Finance is not supporting Ontario municipalities to help compensate for this loss of revenue; now we must recover this revenue through tax rate increases.

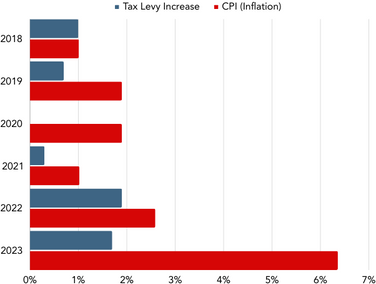

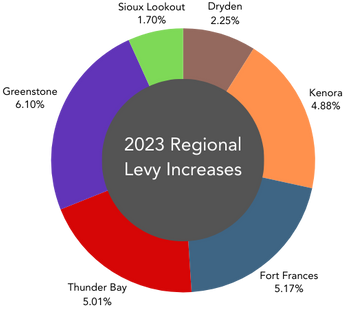

With the province mostly locked down for 2020 and 2021 due to the COVID pandemic, the Municipality’s revenue growth was small in 2021: $74,094 from assessment growth and $36,500 from a 0.3% tax rate increase. Where the affects of the assessment freeze really show themselves is in 2022, when a 1.9% levy increase accounted for over half of the year’s revenue increases. Meanwhile, the CPI (Consumer Price Index, aka inflation rate) jumped by 2.59%. Expenses also shot up that year, due to flooding not seen in Sioux Lookout since the 1940s.  In 2023, the Municipality passed a budget with just a 1.7% tax rate increase, the lowest in Northwestern Ontario. Meanwhile, inflation skyrocketed to 6.36% and revenue growth fell by over $80,000 from 2022. Revenue was increasing less than operating costs. Overall, from 2018 through 2023, Sioux Lookout experienced a combined tax rate increase of 5.60% - while the CPI (inflation rate) shot up by 14.78%. In just six years, our tax rate increases were 9.18% lower than the inflation rate.

In 2023, the Municipality passed a budget with just a 1.7% tax rate increase, the lowest in Northwestern Ontario. Meanwhile, inflation skyrocketed to 6.36% and revenue growth fell by over $80,000 from 2022. Revenue was increasing less than operating costs. Overall, from 2018 through 2023, Sioux Lookout experienced a combined tax rate increase of 5.60% - while the CPI (inflation rate) shot up by 14.78%. In just six years, our tax rate increases were 9.18% lower than the inflation rate.

Most communities in Northwestern Ontario faced significantly larger tax rate increases in 2023. All of them were still below inflation.

Sioux Lookout also has to contend with lost revenues through “exempt assessments.” These are properties primarily owned by the Provincial or Federal Governments. There are currently almost $65 million in exempt assessments in Sioux Lookout. If these properties were taxed at current rates, it would amount to nearly $1.3 million in additional revenue. Instead, Provincial and Federal properties pay just a fraction of actual rates. This is referred to as “payments in lieu of taxes.” For example, Meno Ya Win Health Centre pays “Heads and Beds” to the Municipality in lieu of taxation, amounting to just $6,000 per year.

2023 Expenses and Revenues

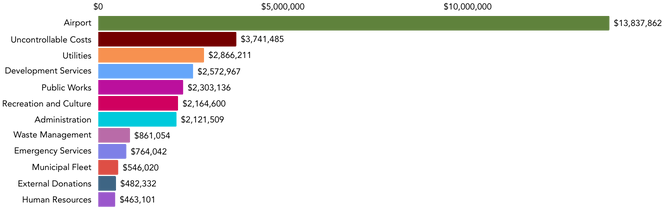

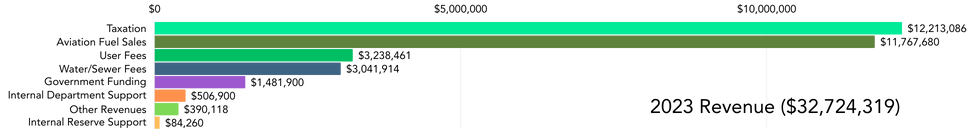

While the Sioux Lookout Municipal Airport appears to be massively more expensive than every other department, this is a bit misleading, since it also has over $12 million in annual revenue that offsets those expenses. (See 2023 Revenue, below.) The Airport is 100% funded through user fees, as are the landfill, Centennial Centre, and our water and sewer systems.

While the Sioux Lookout Municipal Airport appears to be massively more expensive than every other department, this is a bit misleading, since it also has over $12 million in annual revenue that offsets those expenses. (See 2023 Revenue, below.) The Airport is 100% funded through user fees, as are the landfill, Centennial Centre, and our water and sewer systems.

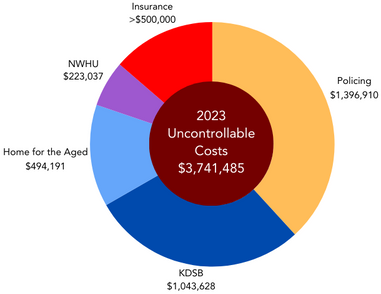

The single largest expense category is ‘uncontrollable costs.’ These are expenses that are mandatory and the Municipality has minimal influence on. This category includes policing costs, levies from the Kenora District Services Board (KDSB), Kenora District Home for the Aged, Northwestern Health Unit (NWHU), and over half a million dollars in insurance costs. There are a few items in this category that Council has a small amount of control over, but is still obligated to pay, that are not included in the chart above, on the right. This includes funding for the Sioux Lookout Public Library and the Travel Information Centre. Council does have more control over donations to local groups and organizations received through requests to Council. Council understands the value these groups and organizations add to our community, and has tried to support such requests to the best of its ability.

The single largest expense category is ‘uncontrollable costs.’ These are expenses that are mandatory and the Municipality has minimal influence on. This category includes policing costs, levies from the Kenora District Services Board (KDSB), Kenora District Home for the Aged, Northwestern Health Unit (NWHU), and over half a million dollars in insurance costs. There are a few items in this category that Council has a small amount of control over, but is still obligated to pay, that are not included in the chart above, on the right. This includes funding for the Sioux Lookout Public Library and the Travel Information Centre. Council does have more control over donations to local groups and organizations received through requests to Council. Council understands the value these groups and organizations add to our community, and has tried to support such requests to the best of its ability.

Specific challenges that will need to be addressed in the 2024 budget include contract negotiations with CUPE Local 2141, anticipated increases to the uncontrollable costs, as well as infrastructure renewal, and development projects to allow for future expansion and growth.

Subscribe to this page

Subscribe to this page